Vietnam Industry Overview: Opportunities for Softwood

Against a backdrop of evolving global trade policies and growing demand for sustainable timber raw materials, Vietnam has established itself as a major player in the global wood furniture manufacturing industry over the past two decades.

To better understand the market potential for imported softwood logs and lumber, FEA held its inaugural Vietnam Softwood Logs and Lumber Forum & Tour November 21–22, 2025, in South Binh Duong, HCMC. More than 80 participants participated in this important event, including delegates from various supplying countries, industry players from China, and local Vietnamese consumers.

The morning session featured four keynote speakers: Paul Jannke (FEA), Ngo Sy Hoai (VIFOREST), Rodolfo Ziegele (Arauco), and Jacob Mannothra (Zindia). These presenters shared their insights about the outlook for US consumption; the fundamentals of Vietnam’s wood furniture industry; Vietnam’s competitive advantages; the country’s domestic timber supply; consumption opportunities for imported softwood within Vietnam; and the current status of India’s softwood trade.

The afternoon session focused on Vietnam’s softwood trade and consumption. Following an introduction by Jane Guo (FEA China), experienced industry players from a wide range of international companies held a series of targeted panel discussions:

- IPP (New Zealand), Greenfield (US), and Mosaic Forests (Canada) discussed international softwood log supply.

- Arauco Wood (Chile), V-W LTD (Brail, Uruguay, and Argentina), and American Softwoods (US) discussed international softwood lumber supply.

- HAWA (Vietnam), Heip Long Fine Furniture Company (China), and Minh Thanh (China) discussed Vietnam’s wood products and furniture manufacturing industries.

- Chinese players Thien Hong Vietnam, Zhong Long Wood Vietnam, and Trans-Viet Rich International Trade discussed production and distribution in Vietnam.

Why Vietnam Matters Today?

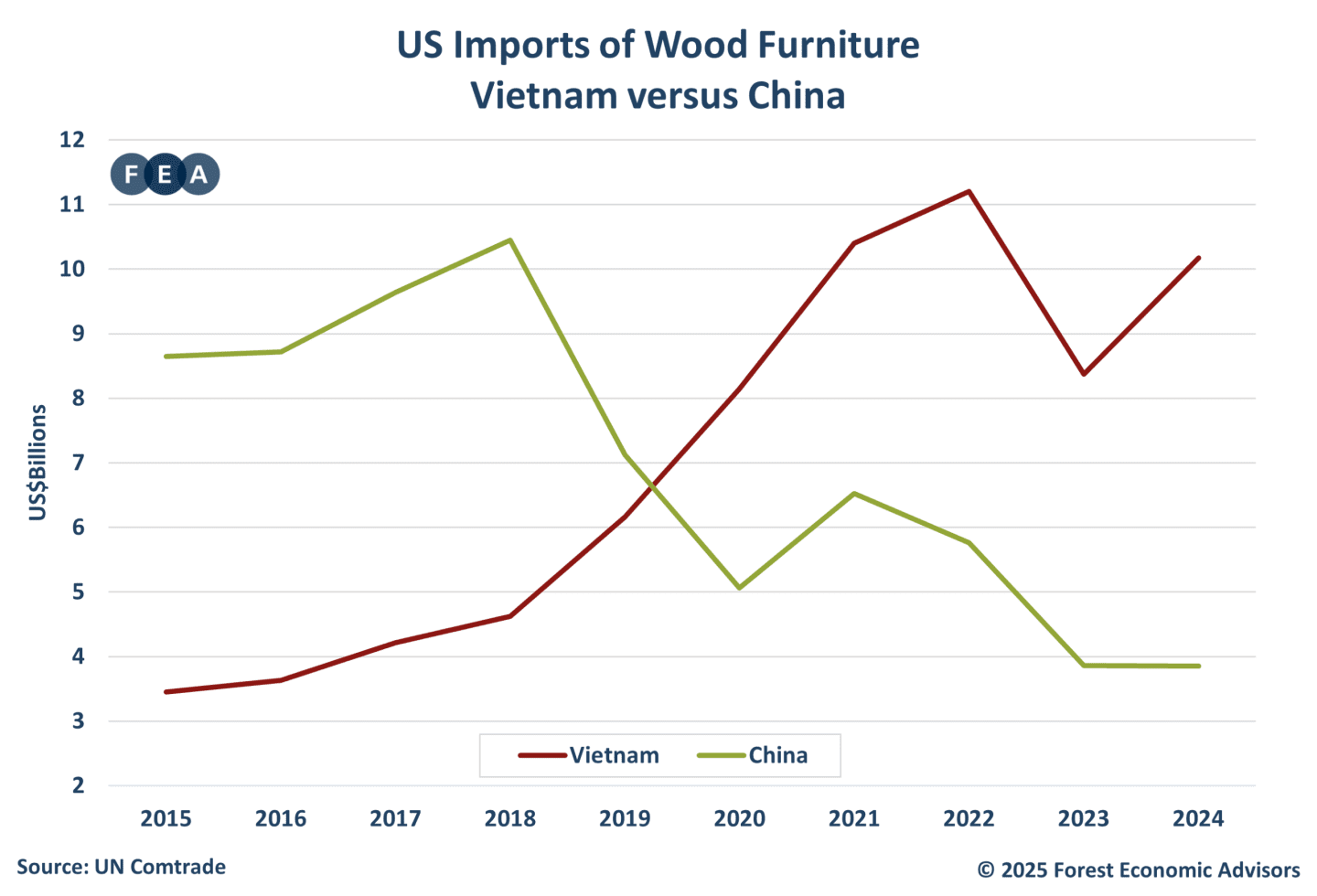

Over the past decade, a significant portion of wood furniture production has shifted from China to Vietnam. This transition has positioned Vietnam as one of the world’s leading wooden furniture exporters, especially to the United States. In 2024, Vietnam’s wooden furniture exports to the US reached US$10 billion, an increase of 20% versus 2023. Vietnam has maintained its position as the largest supplier of wooden furniture to the US through August 2025, accounting for 40% of all imports of wooden furniture and dominating in several categories: kitchen cabinetry, wood-frame upholstered sofas, bedroom furniture, and bathroom vanities.

Vietnam has more than 6,000 wood processing and trading companies, with 700 foreign direct-investment (FDI) enterprises. Two key advantages—low labor costs and an abundant supply of local, plantation-based raw materials—have been mainly responsible for driving export growth.

It is worth mentioning that Vietnam is one of the few countries that has signed a Voluntary Partnership Agreement (VPA) with the European Union. This agreement guarantees the legality, stability, and traceability of Vietnam’s timber supply. Unlike many other countries, Vietnam has proactively prepared for compliance with EU timber regulations, demonstrating a commitment to sustainable industry practices.

While Vietnam has enjoyed a cost advantage over China, this edge is gradually eroding. Labor costs have been rising by approximately 10% annually, and rapid industry growth in such places as Ho Chi Minh City—with its timber industry cluster areas—has driven up land rental and electricity costs. In addition, tariffs and compliance regulations have added further cost pressures.

Vietnam’s current development strategy focuses on expanding smaller domestic acacia and rubber plantations, securing sustainable imported timber supply (particularly for softwood), establishing industry clusters (e.g., in Binh Duong and Dong Nai near Ho Chi Minh City), and improving quality and certifications (including FSC, PEFC, and the local VFCS). The country is also transitioning from original equipment manufacturing (OEM) to original design manufacturing (ODM) and original brand manufacturing (OBM).

Opportunities for imported softwood in Vietnam

There are several primary segments for imported softwood consumption in Vietnam:

- Frames for upholstered furniture

- Table legs, rails, and structural parts, for which strength-to-weight ratio is key

- Glulam and laminated panels for tabletops and shelving

- Furniture: Living room, bedroom, children’s, etc.

- Components, doors, and mouldings for the US residential segment

- Pallets and packaging materials

While tariffs—such as those the US has placed on Vietnamese furniture—create challenges and uncertainty with respect to consumption growth as it pertains to softwood imports, they also present opportunities. For instance, Brazil has faced a 50% US tariff on mouldings and interior décor products (with the latter accounting for 30% of US imports in this category), making Brazilian shipments uncompetitive. The resulting gap presents an opportunity for Chilean and other Asian producers, including Vietnam, to gain market share.

Moreover, Vietnam’s domestic wood product market is flourishing: Valued at $5 billion in 2023, it continues to record growth each year. With a population exceeding 100 million, rapidly rising incomes, and a booming real estate sector, spending on home improvements continues to expand. This is particularly noticeable in the case of softwood furniture due to its popularity among younger consumers. Notably, this trend has led to imports of tropical hardwood falling from 2–3 million m3 annually to 750,000 m3.

Additional drivers were discussed during the panel discussions as possible contributors to Vietnam’s growing demand for imported softwood:

- Growth in demand for sustainable, legally sourced materials

- Rising imports of competitively priced SYP logs and radiata pine logs

- Expanded sawmilling capacity within Vietnam, driven by Chinese operators’ extensive experience in softwood processing

- The relocation of much of China’s outdoor play equipment production sector to Vietnam, spurring additional demand for imported softwood

- A shift in raw materials sourcing toward lower-cost alternatives

FEA intends to continue exploring these trends and opportunities, as well as other developments, at the 2026 Vietnam Softwood Logs and Lumber Forum & Tour planned for November this year. For more details about agenda or sponsor opportunities, please email Paul Jannke at pjannke@getfea.com.

Paul Jannke (FEA)

Mr. Ngo Sy Hoai (VIFOREST)

Rodolfo Ziegele (Arauco)

Jacob Mannothra (Zindia)

Jane Guo (FEA China)

Panel Discussion 2: International SW Log Supplies

Panel Discussion 3: Production in Vietnam

Panel Discussion 1: International SW Lumber Supplies

Group picture

Reception dinner

FEA compiles the Wood Markets News from various 3rd party sources to provide readers with the latest news impacting forest product markets. Opinions or views expressed in these articles do not necessarily represent those of FEA.