Higher Lumber Prices are not a Threat to the US Housing Recovery

Here we go again. Lumber prices have hit a cyclical high and the financial press has generated a raft of stories about how high lumber prices pose a grave threat to the housing recovery. Our personal favorite recent story comes from investor Cullen Roche who notes that he spent $60K on lumber in 2019 for a remodeling job and wonders if he would have cut back on the work had the bill come to $120K or $180K. One wonders if he was expanding a garage to house his replica of Noah’s Ark. More typical, however, is this story of story from Bloomberg with the blaring headline “Staggering Lumber Rally Has Homes Going for $16,148 More”.

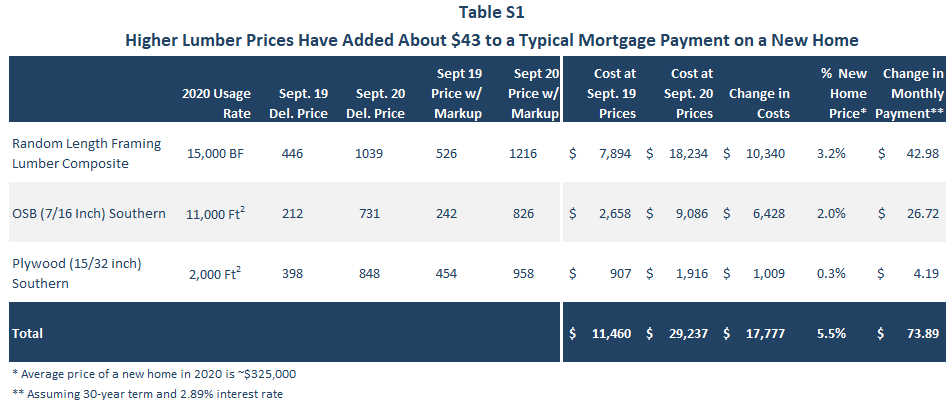

Financial commentators are not the only ones lamenting the rise in lumber prices; the subject also has come up prominently in earning calls for publicly traded homebuilders. Given the stir that the subject has created, we decided it was time to refresh some of the analysis we did during the last cyclical upturn in lumber prices back in the spring of 2018. We’ll start by noting that the term “lumber” is often used as a catch-all for all wood products. Our analysis will look at lumber and wood panels but exclude engineered lumber and hardwood products such as floors and cabinets. We are also careful not to cherry-pick the start dates for this analysis. The widely cited $16K figure for lumber that has been touted by the National Association of Homebuilders (NAHB) uses mid-April as the starting point. Lumber prices hit a temporary bottom during that time, when fear and uncertainly relating to COVID-19 was at its zenith. That data appears cherry-picked to generate the biggest increase possible. We chose to look at the change in monthly average lumber and panel prices from September 2019 to September of 2020.

Our analysis (which ironically is based on detailed NAHB data) assumes that the average new home is 2,500 square feet and that will use about 15,000 board feet of lumber, 11,000 square feet of OSB (3/8-inch basis) and 2,200 square feet of plywood (3/8-inch basis). Dealers typically command a 15- 20% markup on lumber and a 12-15% markup on structural panels. Our industry sources tell us that markups have come down by at least 1% over the past year.

Now all we need to do is take the delivered price for each product, apply the mark-up to it and then multiply by the usage rate in a typical home and we get a very good idea of how much each product contributes to the cost of a home. We started the analysis using the Random Lengths Framing Composite price for lumber and the southern prices for panels (all of these are mill prices). We applied a 17% markup for lumber (down from 18% a year ago) and a 13% markup for panels (down from 14% a year ago) and added a delivery price. We estimate September 2019 delivery prices of $80 per MBF for lumber and $55 per MSF for panels. For September 2020, lumber delivery prices were estimated at $92 per MBF and panel prices are once again estimated at $55 per MSF.

As Table S1 shows, with September 2019 prices and markups, the lumber required to build a typical home would cost $7,894 while the OSB and plywood would cost $2,658 and $907 respectively. Now when we apply September 2020 prices and markups and the lumber costs increase to $18,234 and the OSB and plywood increase to $9,086 and $1,916 respectively. Thus, the total change in lumber prices over past year added $10,344 to building costs while OSB added $6,428 and plywood added $1,019.

These numbers are by no means trivial and it is understandable why builders are unhappy; rising wood products prices reduce their margins in the near term as building products are often purchased after the home price is agreed upon. Further out, builders’ ability to pass price increases on to consumers is largely dependent on market conditions. In a seller’s market (such as we are in now), they should be able to pass most–if not all–of these costs on to the consumer.

It is important to note that even at today’s record high prices, lumber costs only account for about 5-6% of the cost of a $325K home. The biggest drivers of home costs continue to be land and labor costs (which are elevated by poor productivity). Moreover, falling mortgage prices have mitigated some of the damage to affordability caused by rising wood products prices. The 30-year conventional mortgage rate averaged just 2.89% in September, which means that the increase in lumber costs added about $43 to the typical monthly mortgage payment. This is not ideal from a consumer standpoint, but it is hardly a backbreaker.

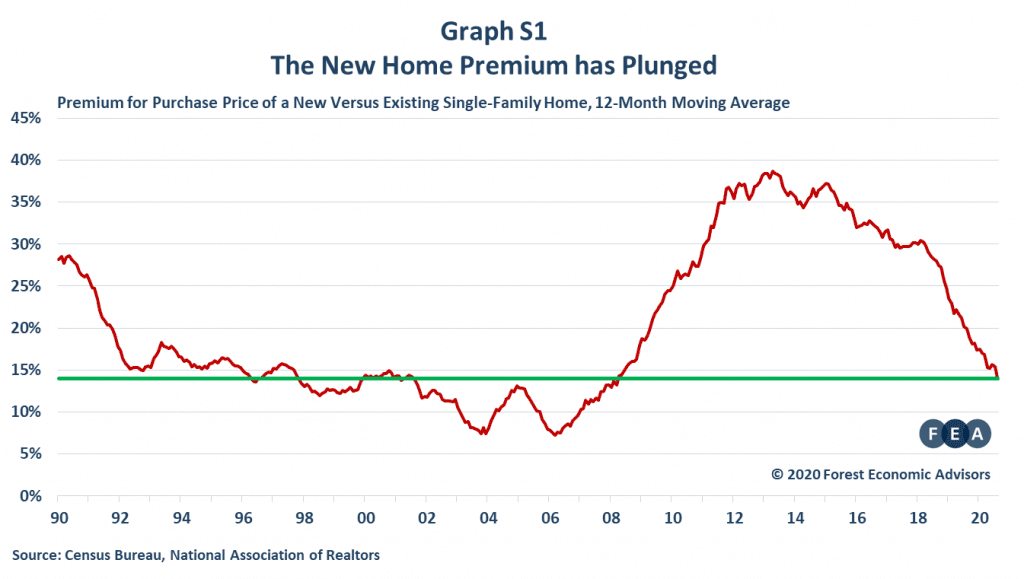

It is difficult to observe changes in land prices directly, but we can make some inferences by observing the premium that a new home price commands over an existing home. If rising land prices are driving up home costs then all else being equal, the premium for a new home compared to an existing home should fall. As Graph S1 shows, that premium has been falling rapidly in recent years, indicating that land prices have likely increased rapidly relative to construction costs. To be sure, this premium does not tell the whole story as builders have been building smaller homes with fewer amenities in recent years in an effort to provide homes to a wider swath of the middle class. However, the average existing home was 1,721 square feet in 2019, well below the 2,505 square feet for the average new home built in the same year.

Compared to other sectors–most notably manufacturing–labor productivity in the single-family home construction sector has been dismal over the last several decades. We are so alarmed by this trend that we developed a conference to address this issue. To their credit, the NAHB has recognized the need to increase productivity in the sector. As builders successfully begin to morph construction sites into assembly sites, the labor cost savings will vastly outweigh the cost savings associated with lumber prices returning to 2019 levels.

Why are Lumber Prices So High?

The supply of lumber is inelastic (or insensitive) to changing prices in the near term as it takes months for the industry to ramp up production in response to an upside surprise in demand. Recall that back in the mid-March through mid-May period, the vast majority of industry decisionmakers expected to see sharp declines in new home construction and remodeling activity and they made production plans to account for a weak demand environment. Since about June however, we have seen the mother of all upside demand surprises as renovation activity and new construction activity have surged beyond even the most optimistic forecasts.

In the meantime, the wood products sector has struggled to ramp up capacity to meet this demand. The industry has invested a significant amount of money trying to keep up with growing demand. Firms are adding shifts and running their mills to the fullest extent possible while still maintaining their workers’ safety given COVID-19 concerns. New greenfield mills, expansions and debottlenecking has lifted production but not by enough to keep up with surging demand. The interesting thing to note on the production increases is that they started in June, while mills were still concerned that a V-shaped recovery would not happen. We don’t have August or September data yet, but when we do get it, we expect to see substantial increases in production. These increases would be even higher but for the challenges posed by the wildfires in the West and, to a lesser extent, the hurricanes in the South.

Prices are likely near a peak as seasonal demand will soften as more production comes online. Even so, we do not expect prices to return to 2019 levels anytime soon given the strong outlook for new home construction and remodeling activity and the ongoing fiber constraints in all areas outside of the US South.

Trade Restrictions Are Having Virtually No Effect on Lumber Prices

FEA takes no position on whether the US trade restrictions on Canadian lumber imports are justified or not. However, we will say that at this time when we are witnessing a massive gap between robust demand and tight supply, that the trade restrictions are having a negligible (at most) effect on lumber prices. In every producing region of Canada, the amount of the duties pales in comparison to the increase in profits over the past several months, A Canadian firm would be foolish not to sell into this booming market to save a small amount on duties. Our contacts in Canada tell us that they are producing as much they can given the diminished fiber availability north of the border.

Moreover, it is important to remember that structural panels such as OSB and plywood are subject to many of the same supply and particularly demand drivers as lumber. In addition, there are currently no trade restrictions between the US and Canada on OSB and plywood. Yet prices for each have risen by 331% and 131% OSB and plywood respectively between September 2019 and September 2020. By comparison, the Random Lengths Framing Lumber Composite price has risen by 159% over that same timeframe.

The Housing Market is Shrugging Off Higher Lumber Prices

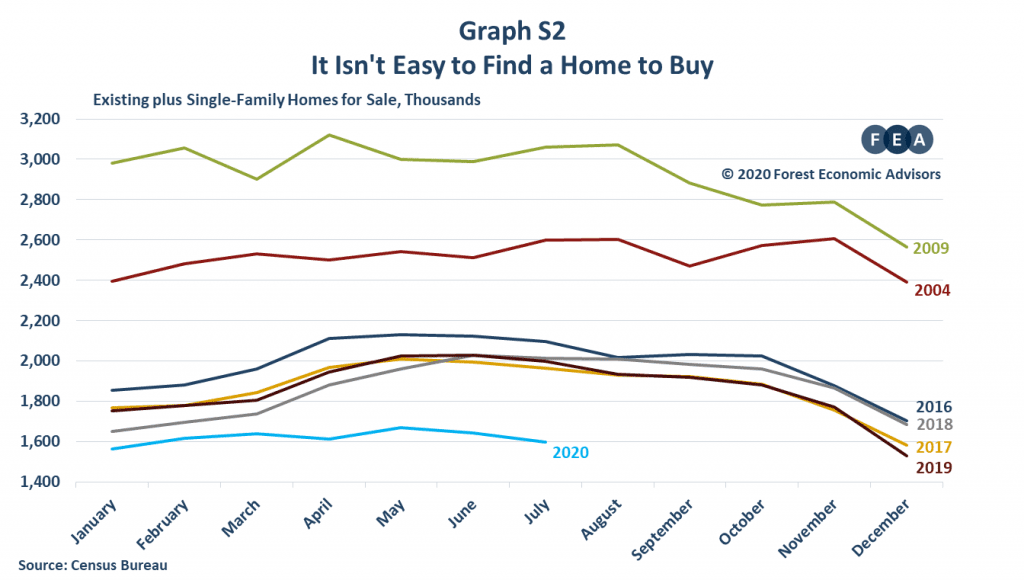

By virtually every measure, the new home construction sector is booming despite high wood products prices. New single-family home sales hit a 14-year high of 1.01M in August and the NAHB reports that Builder Confidence hit an all-time high in September despite the increase in building materials prices. Virtually every indicator of housing demand is flashing green at a time when virtually every indicator of housing supply is showing shortages. The inventory of new single-family homes for sale has collapsed to a record low of 3.3 months of supply at the current sales rate and inventories of existing single-family homes for sale are even lower at 3.1 months of supply. Graph S2 shows just how difficult it is to find a house to buy in 2020. In market conditions like these, it is hard to believe that builders will be the one absorbing increases in lumber costs.

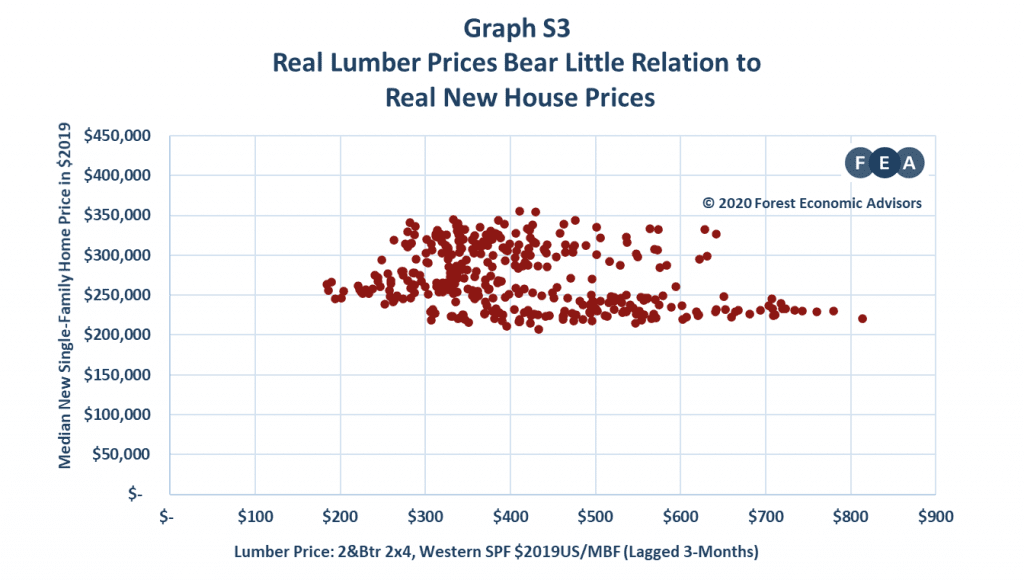

Lumber prices have very little to do with new home prices. To test this assertion, we made a scatterplot of real lumber prices versus the real median single-family home price going back to 1990. One can stare at this plot (Graph S3) for hours and be hard-pressed to determine a causal relationship. We ran a regression and found that the slope went in the wrong direction i.e. higher lumber prices where associated with slightly lower real home prices and that the R-squared (a measure of goodness of fit) was a minuscule 0.094.

It is certainly possible that we are overly optimistic about the near-term outlook for the residential construction market; but we can say with confidence that if this nascent boom dies, higher lumber prices will not be a suspect.

FEA is the premier supplier of independent forecasts and analysis for the North American and global wood products and timber sectors. If you would like more information what we have to offer, please contact David Battaglia at sales@getfea.com.

FEA compiles the Wood Markets News from various 3rd party sources to provide readers with the latest news impacting forest product markets. Opinions or views expressed in these articles do not necessarily represent those of FEA.